Stop Bleeding Profit: The Contractor’s Guide to Smarter Payments

Introduction

Margins in construction are already under pressure from rising material costs, labor shortages, and economic uncertainty. The last thing you need is your payment system stealing an extra slice of your profit. Let’s explore how contractors can take back control.

The True Cost of Payment Processing

Processing fees average between 2.5% and 3.5%. On just $1M in revenue, that’s $30,000 in losses. For many small to mid-sized contractors, that’s the difference between a strong year and breaking even

Why Traditional Systems Fail Contractors

Generic processors aren’t built for the construction industry. They don’t account for big-ticket jobs, deposit schedules, or the unique cash flow challenges contractors face.

Modern Solutions: ACH, Dual Pricing, and More

Contractors now have tools to solve these problems:

ACH Payments: Cheaper and faster than cards.

Dual Pricing: Pass card fees back to the customer.

Instant Deposits: Keep your projects moving without waiting days.

Real-World Example: The $600 Swipe

Consider a roofing contractor who takes a $20,000 card payment. At 3%, that’s $600 lost in seconds. With Builder Pay Pro’s dual pricing, that same job costs $0 in fees. Multiply that over dozens of jobs per year — that’s tens of thousands back in your pocket.

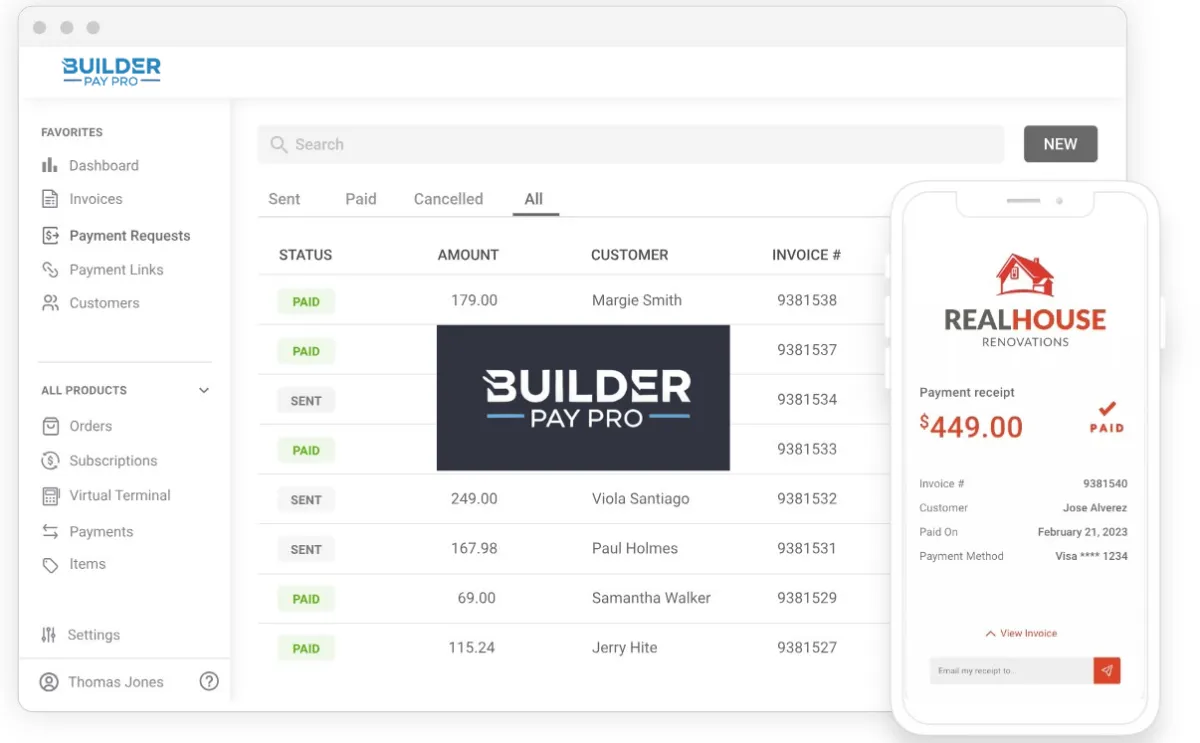

The Builder Pay Pro Advantage

Builder Pay Pro was designed by contractors, for contractors. It solves the exact pain points that generic processors ignore:

Dual pricing transparency.

Instant ACH deposits.

Seamless QuickBooks integration.

No hidden costs.

Conclusion

Your profit belongs to you, not your payment processor. By switching to smarter systems like Builder Pay Pro, you can finally stop bleeding profit and start building a stronger business.

👉 Take the first step toward zero-fee payments at Builder Pay Pro